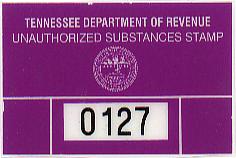

Tennessee’s Illegal Drug Tax

For a second consecutive year, the state Department of Revenue concealed the failures of the Unauthorized Substance Tax.

In a press release issued Tuesday, the Department praised the Unauthorized Substance Tax, or “crack tax,” for generating $1.7 million in revenue collections. The Department, however, conveniently failed to mention that three-fourths of the revenue generated by the tax goes to local law enforcement agencies. Only one quarter of the $1.7 million generated by the tax – about $440,000 – actually reached state coffers in 2006.

Since the crack tax requires over $800,000 per year to administer, the tax actually results in a net cost to taxpayers.

“Only in government would a tax that costs nearly twice as much to collect as it produces in revenue be called a ‘success,’” said Tennessee Center for Policy Research president Drew Johnson.

It’s a success not due to collections but due to the fact that Johnny Law can now take your house, car, and land without due process of law. He’s just collecting taxes.