TN Supreme Court

TN’s waiver of due process of law err illegal drug tax:

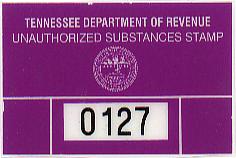

In a separate case, Brad Buchanan tried today on behalf of the state Department of Revenue to convince the state high court to overturn a lower appellate court ruling striking down as unconstitutional the state’s Unauthorized Substance Tax Act, more commonly known as the “crack tax.”

Under the law, the illegal wares of drug dealers were to be taxed. Dope peddlers could voluntarily pay the tax with the promise of anonymity but those who failed to do so but wound up busted by police were assessed the tax whether or not they were ultimately tried or convicted of criminal charges.

A Davidson County chancellor deemed the tax punitive in nature and, therefore, afoul of constitutional protections including the right to due process and the right against being punished twice for the same crime. The state Cout of Appeals also struck down the tax but for different reasons, arguing the state cannot tax an illegal activity or product.

Defense attorney Phil Lomonaco, on behalf of Lenoir City construction worker Steven Waters, asked the Supreme Court today to keep the crack tax out of Tennessee’s tax code.

“It is conditioned upon a crime,” Lomonaco said. “This is purely a tax on an illegal activity.”

Actually, it’s not a tax at all. It’s a scheme to take a person’s property without due process of law.

May 8th, 2008 at 9:38 am

Iowa has has a similar tax since the mid 80’s. I’ll admit I have no clue as to how it is enforced or the revenue received. I do know it has been used as additional fines for whent the perpetrator is arrested.

Never really thought about how it could be misused. To much trust?

May 8th, 2008 at 11:32 am

Funny but the state legislature doesn’t seem fired up to pass an “unauthorized income” tax. You’d think it would be just as valid and who could argue with taxing bribes and kickbacks? It’d only be another line on the TN income tax form. So it would be little administrative burden. All very confidential. But I guess that would be punitive and unfairly target corrupt politicians.

On the other hand, if all the politicians got right with the tax man, it might go a long way toward solving Tennessee’s revenue crisis.

May 8th, 2008 at 11:49 am

Wow, I always used this as an analogy for gun control. (Ie you make stricter licence requirements….the criminals don’t follow it, because they can’t own a gun in the first place, ect)

I didn’t know anybody was stupid enugh to TRY it.

If you’re selling crack, a little “Tax Fraud” is hardly going to upset your stomach….

May 8th, 2008 at 12:42 pm

No, but consider the implications of the argument against the tax. If anyone is charged with the crime of tax evasion, should he be able to defend against the charges by pointing out that he also committed a different crime? That makes about as much sense as getting out of a traffic ticket by explaining to the judge that at the time of your infraction, you were fleeing from a bank you had just robbed.

May 8th, 2008 at 12:53 pm

Not being familiar with the TN constitution I have to ask does it specifically have a section that spells out the government has the power to decide and outlaw drugs (think federal 18th)?

I’ve looked for the federal amendment naming “hard drugs” and granting congress the power to legislate against them and providing the means to back up that legislation but it eludes me.

Without that there can be no “illegal drugs” can there?

May 8th, 2008 at 3:28 pm

Doesn’t the NFA of the 1930s (the “ban” on machine guns) operate on the same principle, i.e. it’s a tax measure…?

May 8th, 2008 at 3:29 pm

It’s like that line from Star Trek III

Dr. McCoy: “How can you get a permit do to a damned illegal thing?”

May 8th, 2008 at 4:40 pm

The NFA FFL is a “tax”. It was done that way since it was enacted before the all things are commerce interpretation gave Uncle sweeping powers. However, it is/was a tax in the same way as your car registration is. If anyone paid the tax, you could possess the taxed item. The TN tax however is a tax on an item that you may not possess even if you pay the taxes. It is just a non-judicial method to go after an offender. Raid the suspect, confiscate “proceeds”, impose tax penalty, never get around to filing criminal charges. It is the intent and use of the tax to “punish” the offender that is causing the courts to rule against it.

BTW, confiscation isn’t quite what many think it is. If you can show legitimate sources for the income that bought the goods, then confiscation usually doesn’t work. However, if you have a $50,000 truck but haven’t had documented income of at least that much plus living expenses in the last 3 years, you have a problem.

May 8th, 2008 at 10:29 pm

“… whether or not they were ultimately tried or convicted of criminal charges.”

They didn’t even try that on Capone!

JKB said “BTW, confiscation isnít quite what many think it is. If you can show legitimate sources for the income that bought the goods, then confiscation usually doesnít work.’ Unless RICO is invoked.

It is getting to the point where your house can be confiscated because someone claims you did something illegal, and when you say you will fight it when you go to court on the criminal charges the response will be “Who said anything about [charging you and] trying you?” And you can’t take it to a civil court, because it is a criminal matter. The IRS has been pulling this sort of thing for decades, saying only an administrative IRS “court” has jurisdiction over tax [and] confiscation disputes: since RICO, everyone is getting into the act. Not that RICO is all that bad a law in intent – but it is allowed to be used on flimsy (or non-existent) grounds.

May 8th, 2008 at 11:41 pm

Apples and oranges. The federal government is one of enumerated powers. State governments are not. Ergo, when examining the constitutionality of a state law, the question to ask is what part of the Constitution prohibits it, not which part specifically authorizes it.

May 9th, 2008 at 10:35 pm

So anything NOT included in a state constitution means they can have a go? well that makes perfect sense in our current black-is-white, white-is-black world.

May 10th, 2008 at 12:04 am

That’s basically right. States have the police power, a general power to legislate for the general welfare. That’s the rule. The federal government, which is limited to its enumerated powers, is the exception, and one created on purpose to preserve the general police power of the states.

May 10th, 2008 at 12:05 am

OTOH, it’s not a function of a “black is white and white is black” world, but of a “states aren’t the federal government and the federal government isn’t a state” world.