TN Supreme Court Rules Tennessee’s Illegal Drug Tax Is Actually An Illegal Drug Tax

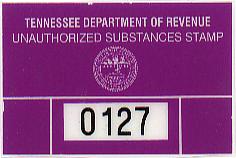

Look at me! I’m unconstitutional. Soon to be a collector’s item.

Basically, the majority said that illegal drugs are not subject to taxation under the state constitution, which authorizes taxes on “merchants, peddlers and privileges.” The tax is on possession, they reasoned, not sales so the possessors are not merchants or peddlers. And since possession of the products in question is outlawed, it’s not a legal privilege subject to taxation.

The majority did reject arguments that the law violates the U.S. Constitution’s provisions against self-incrimination and double jeopardy. In theory, that means the Legislature could revise the law – as in making the tax apply to sales of the drugs – and the statute could pass legal muster.

I think this is about the fourth time the tax has been ruled unconstitutional and about the third different reason.

July 27th, 2009 at 7:03 pm

OK, I read the aricle at the link. I still don’t get it.

Tennessee passed a law that you can get a tax stamp for illegal contraband (IC) that you have in your possession. So when you get caught with the IC in your possession, you show the tax stamp and get a “Get Out of Jail Free Card” (GOOJFC).

But you have to make sure you buy the Tax Stamp before acquiring the IC right? So if you get busted when buying the IC from an undercover cop you have the tax stamp to wave under the police’s nose and get your GOOJFC.

Right?

Just curious.

July 28th, 2009 at 1:09 pm

To quote Dr. Leonard “Bones” McCoy from Star Trek III: The Search for Spock,

“How can you get a permit for a damned illegal thing!”

If only a court would declare the NFA tax thing unconstitutional….