Illegal drug tax overturned

A Tennessee judge has ruled that a state law requiring drug dealers to pay taxes on their cocaine, marijuana and other illicit drugs is unconstitutional.

The ruling by Davidson County Chancellor Richard Dinkins bars the state from collecting $1.1 million from Jeremy Robbins, an East Tennessee man who was arrested on federal drug conspiracy charges and ordered to pay taxes on marijuana he is accused of illegally possessing.

But it could potentially cost the state much more if the decision is upheld by higher courts and interpreted as applying to the entire state.

Good. It was a stupid idea and now it’s just stupider. The purpose of the tax was to provide a means for law enforcement to enhance its coffers and this law allowed that by making it a tax issue. It also had the added benefit of completely disregarding due process of law before seizing assets. Sadly:

Last night, state officials said they would continue to enforce the tax, which has brought more than $2.7 million into state coffers since it went into effect in January 2005.

“They’re just turning a blind eye and a deaf ear to the opinion,” said James A. H. Bell, one of the Knoxville lawyers who brought the case on behalf of Robbins. He described the state’s attitude as “cavalier.”

The chancellor’s decision, handed down Monday, applies only to Robbins and, in any case, the state plans to appeal, said Sharon Curtis-Flair, spokeswoman for the state attorney general’s office.

If it’s unconstitutional, why does it apply only in one case? And this bit is scary:

Since 2005, state Department of Revenue officials have assessed $51 million in drug taxes owed, with the vast majority of the money going uncollected.

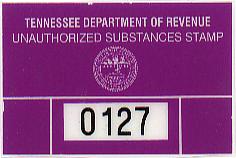

Very few people have actually bought the stamps. During the law’s first year, taxpayers spent $1,492 in stamps for illegal drugs.

That’s a lot of money. And people didn’t buy the stamps because 1) it’s fucking stupid and 2) the state made it unnecessarily difficult to do.

The court agreed with SayUncle’s due process findings:

“The court concludes that the manner in which the tax is assessed deprives taxpayers of due process and, to that extent, the statute is unconstitutional on its face,” the chancellor wrote.

He also found that levying the tax and charging someone with a crime was equivalent to double jeopardy because it punished the dealer twice for the same crime.

“(The) statute violates the double jeopardy provisions of the Fifth and Fourteenth Amendments to the United States Constitution and … the Tennessee Constitution to the extent it may be employed against a dealer otherwise subject to state prosecution relating to the unauthorized substances subject to the tax proceeding.”

SayUncle: Like the courts, only faster.

Update: In comments, Xrlq says not so fast. Read it.

July 12th, 2006 at 8:58 am

Stunned, I am. Hope the decision withstands appeal.

July 12th, 2006 at 9:47 am

[…] « « Illegal drug tax overturned | Home | […]

July 12th, 2006 at 9:53 am

Because that’s how lawsuits work. At the trial or district court level, the decision binds only the parties, and only with respect to the case before that court. Appellate decisions are binding precedent, lower court cases are not.

Slow down, cowboy, the appeals are just beginning. If the judge’s actual decision reads anything like the snippets quoted here, the chances of this ruling surviving on appeal are slim to none, and Slim just left town. Take, for instance, this:

Neat, but how are they going to do that? If a drug dealer tells another drug dealer that he bought a tax stamp, or shows it off to him, or whatever, he’s got no one but himself to blame. The only plausible source for law enforcement to obtain this information is from the Department of Revenue itself, which holds it in confidence. Even if a particular dealer could show that someone independent of Revenue had independently learned of the purchase of a stamp through no fault of the dealer’s own, that would be an argument for excluding the evidence of that purchase in that particular case; it wouldn’t constitute a valid attack on the tax itself.

Then, there’s this:

Jesus on a pogo stick, has this judge never heard of Al Capone?! If he really thinks taxes are a “punishment,” perhaps he should next rule that all taxes I pay are unconstitutional since I am being punished once for an act that isn’t a crime at all, and in some cases is even constitutionally protected. Or, if I can show I’m paying a tax on something that’s already been taxed, that must constitute double jeopardy. Right?

This judge is a prime example of why lower court rulings do not and should not set binding precedents, on constitutional matters or on anything else. It’s bad enough that these knuckeheads get to interpret laws for the few unlucky souls who happen to be arguing their cases before them. Do we really want these guys deciding what the law is for everyone else? Before you answer that, consider that just because this judge’s legally illiterate idiocy happened to result in a political outcome you favor, there’s no reason to believe the next one will, or the one after that, etc.

July 12th, 2006 at 10:34 am

I wouldn’t be quite so quick to throw out double jeopardy.

The Supreme Court has ruled against a marijuana tax law under double jeopardy in the past

(See Department of Revenue of Montana vs. Kurth Ranch). The key in that particular case was that the tax was clearly of “penal and prohibitory intent rather than the gathering of revenue.” Justice Stevens made it clear that high taxes alone, or taxing an illegal product, or even an attempt to use the tax as a deterrent, wouldn’t necessarily make a tax double jeopardy. But in the case of Montana vs. Kurth Ranch, “Persons who have been arrested for possessing marijuana constitute the entire class of taxpayers subject to the Montana tax.”

Since then, the states have gotten a little smarter in how they word their marijuana tax laws and even pretend that they have provided a way for people to actually come in and buy the stamps (although in actual fact, the only ones who do so are collectors and the state has little actual belief that illegal drug sellers are buying them). This seems to have given many state supreme courts an out based on Stevens’ language in Montana. The Kentucky Supreme Court ruled against double jeopardy in 1998 saying that the tax “is not contingent on the commission of a crime.” A similar ruling came down in Kansas.

However, in Indiana, (Bryant v. State of Indiana), the Indiana Supreme Court found the state’s drug tax punitive in nature and forbade levying a tax assessment and pursuing criminal protection in the same case. (Link)

In Arizona, an enterprising drug dealer went out and purchased a $100 drug dealing “license” issued by the state prior to his trial and the judge threw out his conviction on dealing because he said the state couldn’t punish him for doing something they had licensed him to do.

The drug tax stamp is still a hodgepodge of various state legal opinions dancing around the murkiness of Montana v. Kurth Ranch. Double Jeopardy may end up being a hard sell in the higher courts in Tennessee, but I wouldn’t rule it out too quickly.

July 12th, 2006 at 10:46 am

It seems clear the intent of the taxation was punishment.

I would like to see this case push forward even more on the laws allowing for seizure of a person’s entire assets after a drug arrest but before any conviction. That is so blatantly unconstitutional, but government and law enforcement make so much money from this tactic, they support it and the public won’t support a review of the law for fear of appearing to support the sale of illegal drugs.

July 12th, 2006 at 11:15 am

I don’t much care for giving the state, in conjunction with law enforcement, another seizure laws that amount basically to conflict of interest.

July 12th, 2006 at 11:17 am

Pete, I think you’re misreading Kurth Ranch case. The double jeopardy issue in that case depends not only on the holding that the tax in question was punitive (a 5-4 decision, I might add), but also on the fact that it was imposed after the defendants had pleaded guilty to, and been sentenced for, the crime in question. Had they been charged with both offenses together, and either been convicted of both simultaneoulsy or copped a plea that involved admission of guilt for both, there wouldn’t have been a double jeopardy issue at all. Justice Stevens acknolwdges as much in that case:

August 24th, 2007 at 8:56 am

[…] Tennessee’s illegal drug tax was overturned once already. Now, it’s been suspended once more: Two Knoxville lawyers who convinced a chancellor to strike down the state’s so-called “crack tax” as unconstitutional now have won a rare restraining order against the agency that collects it. […]