That time already?

Update: MKS has more. And here’s the presser:

During the second year of Tennessee’s unauthorized substances tax, the Tennessee Department of Revenue collected $1,773,535 and assessed $43,187,787. Year one of the unauthorized substances tax resulted in $1,714,565 in collections and $32,172,918 in assessments. Created by Public Chapter 803 and effective Jan. 1, 2005, the tax applies to controlled substances and certain illicit alcoholic beverages, including cocaine, crack, methamphetamine, marijuana, moonshine, and non-tax-paid liquor.

Translation: We’ve laid claim to $43M in property without due process of law.

Update 2: Fine, fine. Here’s a link to all my past entries on Tennessee’s illegal drug tax.

January 3rd, 2007 at 12:01 pm

All taxes are levied “without due process of law.” Why aren’t you more upset about taxes on legal substances?

January 3rd, 2007 at 12:06 pm

Because those taxes generally are meant to be revenue measures and are taxes. This measure is just another means to confiscate property in the name of unpaid taxes.

January 3rd, 2007 at 1:00 pm

I’m with you on the nonsense of seizure of property.

I was reading just last week that marijuana was the number one cash crop in the state, and in many others. If it were legal to grow and sell – heaping gobs of tax revenues.

And I still am confused as to how you can get a tax stamp for non-tax-paid liquor and then still be in posession of non-tax-paid liquor.

January 3rd, 2007 at 2:01 pm

Doesn’t a tax stamp on your unauthorized substance make it an authorized substance?

Say Uncle is quite right about the difference between revenue measures and this.

January 3rd, 2007 at 7:06 pm

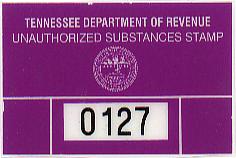

Has anyone actually bought one of those stamps yet?

January 3rd, 2007 at 8:08 pm

justin, you noticed the image of one?

A reader bought it.

January 4th, 2007 at 10:17 am

I understand ya’ll about taxing and tax money spent to tax. It is very interesting about untaxed legal alcohol. We do not have bright thinkers on the hill. I have a strong stand on the fact that these criminals are paying a state tax for their products but not paying the local tax portion. Some of the crimes that come from their business affect the local community; we should be able to keep some of that tax right here in the neighborhood where the products were sold. I was just adding to what I think is the worst and very wasteful piece of legislation our state has.